does binance send tax forms canada

Yes binance does provide tax info but you need to understand what this entails. Looking for a AT HOME JOB.

Binance P2p Trading Frequently Asked Questions Binance

Yes binance does provide tax info but you need to understand what this entails.

. Firstly click on Account - API Management after logging into your Binance account. The IRS will receive a duplicate copy of your Form 1099-K. From the dropdown menu select Binance and then choose Sync via API.

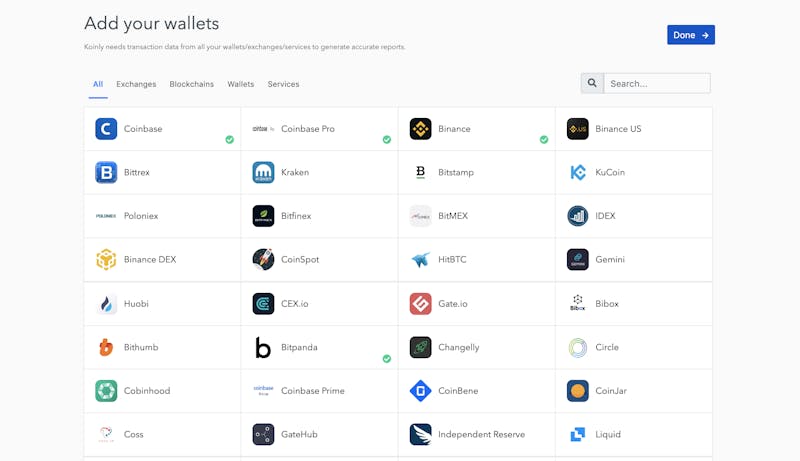

No Binance doesnt provide a specific Binance tax report - but it is partnered with a variety of excellent crypto tax apps like Koinly that. Click on the link to view your API key and secret and then click Edit and uncheck Enable Trading. For your Tax Report youll receive a unique API and Secret Key.

Be mindful that because Binance is outside of Canada you may be require to file a T1135 form with the Canada Revenue Agency. We have integrated Binance via API on BearTax with which one can consolidate trades review depositsreferrals calculate capital gains and download tax forms within few minutes. Log in and navigate to the Import Data section of your account.

Binance allows exporting trades for a 3 month period at a time. If you want to access Binance from Ontario you will have to use a VPN. At the time of writing as a Canadian you could open an account with Binance.

The UKs Financial Conduct Authority FCA noted that Binance Markets limited was not permitted to offer regulated business in the UK in June 2021. Here is a step by step procedure on how to get your tax info from Binance. If your account meets both of the above criteria BinanceUS will send you a Form 1099-K in January 2021 to your accounts address of record.

This transaction is considered a disposition and you have to report it on your income tax return. The IRS states that US taxpayers are required to report gains and losses or income earned from crypto rewards based on certain thresholds on their annual tax return Form 1040. Yes BinanceUS sends Forms 1099-MISC to traders who have earned more than 600 on the platform from staking and rewards.

You will be emailed a link to confirm your API Key. You can use a ZenLedger to combine your tax report. Report the resulting gain or loss as either business income or loss or a capital gain or loss.

Similarly our tax software enables you to sell tax lots carefully to recoup losses before the end of the tax season. Does Binance provide a tax report. Does Binance Send Tax Forms Canada.

It operates in Canada but not in Ontario. For those types of people they could handle the kind gesture from the Gov. Similarly our tax software allows you to selectively sell off tax lots to harvest your losses before the end of the tax season.

Instead your crypto capital gains are taxed at the same rate as your Federal Income Tax rate and Provincial Income Tax rate. Although it previously issued certain traders Forms 1099-K BinanceUS discontinued the practice in favor of. Imagine if Binance establishes partnership with us and has this capability in-built to send out tax forms directly to your email - that would be a great step towards.

Click send code to receive a verification code to your email address. Also Binance is unavailable to those in Ontario and if this is you they would have asked you to close out your account by the end of 2021. Binance banned Ontario residents from using the platform in the summer of 2021.

Paste the copied API Key and Secret Key from. Income 2021 Income 2022 15. Sign in to BinanceUS API Management.

Copy and paste your keys here. Yes binance does provide tax info but you need to understand what this entails. You can also declare your loss so if you lost 100 on another transaction its like you made 0 profits.

Now choose Create Tax Report API. Upload your CSV or XLSX files here. Yes Binance does provide tax info but you need to understand what this entails.

By law the exchange needs to keep extensive records of every transaction that takes place on the platform. Click on Export Complete Trade History at the top right corner. You have to convert the value of the cryptocurrency you received into Canadian dollars.

But remember - youll only pay tax on half your capital gain. However you need to keep in mind that you wont be able to fully verify your account if you have an Ontario ID. Making 80 500 a day.

In theory every transaction is a taxable event. However the question of whether Binance the worlds largest cryptocurrency exchange is legal. Meaning you will need to.

Binance CTC import API key. Name your API Key and click Create New Key button. If you bought a crypto 100 and sell it for 200 you have to declare 100 of profits.

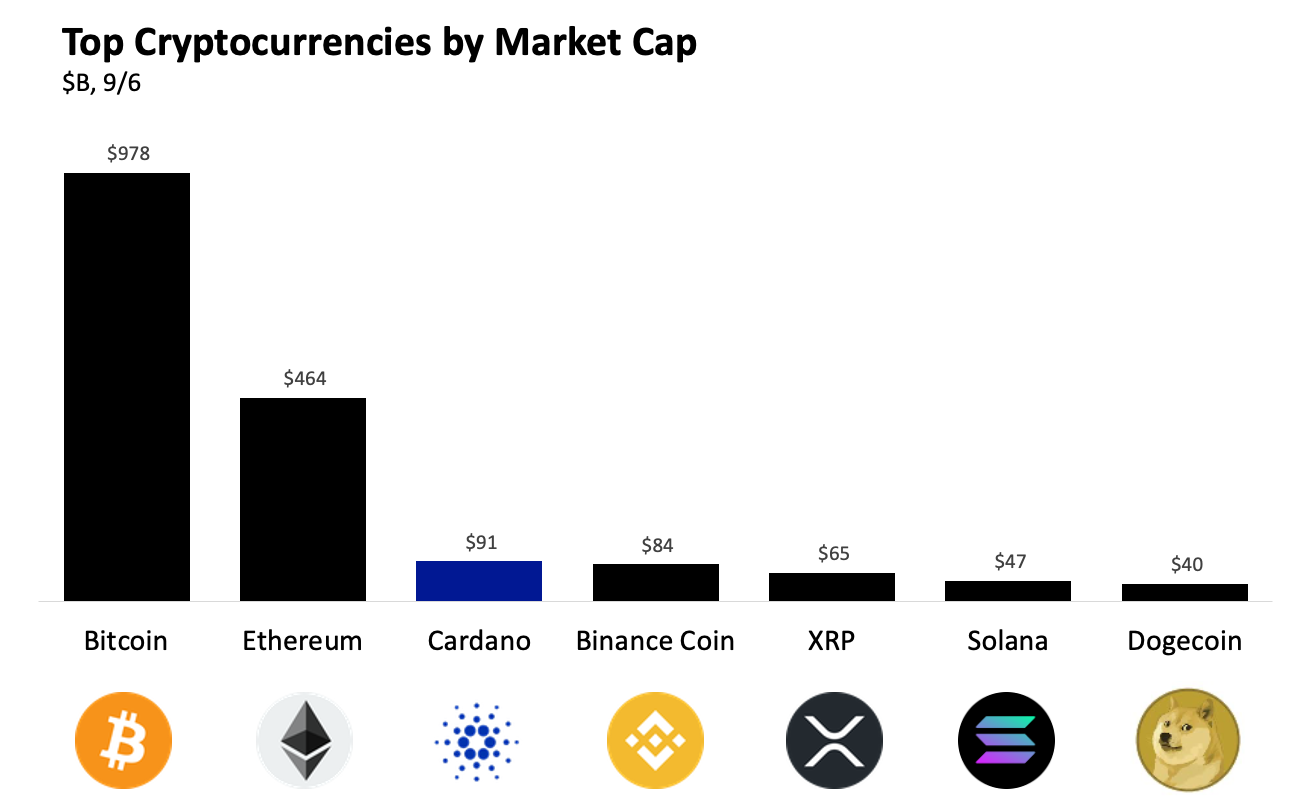

Three of the main jurisdictions where this happens are the United Kingdom the United States and Canada. Yes Binance is legal in Canada except in Ontario. You can see the Federal Income Tax rates for the 2021 and 2022 tax years below.

Does Binance Send Tax Forms Canada By - May 4 2021 0 In canada the capital gains tax rate is 50 so youll pay 1000 of that profit in capital gains taxes. The cra is behind the curve when it comes to crypto tax in general so well preface this by saying there is no clear guidance from the cra about defi tax in canada. Binance is banned or restricted or has been issued warnings in the following jurisdictions.

This goes for ALL gains and lossesregardless if they are material or not. BinanceUS makes it easy to review your transaction history.

Binance P2p Trading Frequently Asked Questions Binance

Binance P2p Trading Frequently Asked Questions Binance

Binance To Cease Operations In Canada Amid New Regulations Cointribune

Binance Us Review Pros Cons And More The Ascent By Motley Fool

3 Steps To Calculate Binance Taxes 2022 Updated

3 Steps To Calculate Binance Taxes 2022 Updated

Crypto Tax Reporting Tools For Accountants Koinly

Ten Reasons Why You Should Be Using Trust Wallet Binance Blog

3 Steps To Calculate Binance Taxes 2022 Updated

9 Exchanges To Buy Crypto Bitcoin In Hawaii 2022

3 Steps To Calculate Binance Taxes 2022 Updated

Binance P2p Trading Frequently Asked Questions Binance

Proof Of Work Binance Gets Hacked

Binance Us Review Pros Cons And More The Ascent By Motley Fool

![]()

Crypto Tax Software For Beginners And Experienced Traders Cointracking

A Greener Crypto Future The New 3 Crypto Cardano Deep Dive

3 Steps To Calculate Binance Taxes 2022 Updated